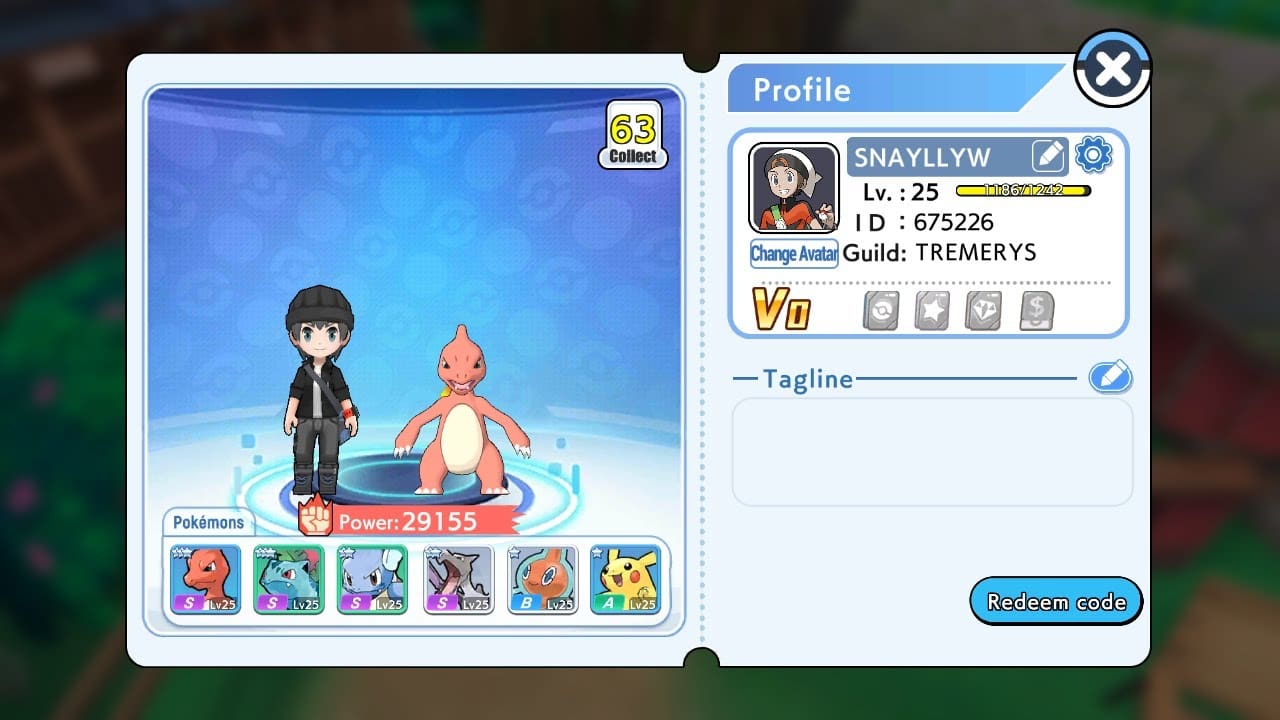

Gearup Booster Redeem Codes February 2024 – Easy Guide

February 7, 2024

Zerodha Clone App Redeem Codes February 2024 And Guide To Apply

February 7, 2024

MLBB EDOT.PH MLBB – Scan the QR Code and Redeem now

January 27, 2024

Skull And Bones Patch Notes 1.3

March 24, 2024

MapleStory Minar picnic GMS Patch with Bonus Event

March 24, 2024

Dragon’s Dogma 2 How to Unlock Magick Archer Vocation!

March 24, 2024

![Fix: Roblox Unable To Send Friend Request Error | Roblox Can't Send Friend Request 6 Bloxflip Promo Codes (February 2024) [Updated List!]](https://b3300814.smushcdn.com/3300814/wp-content/uploads/2023/10/Roblox-Bloxflip-Promo-Codes.jpg?lossy=2&strip=1&webp=1)

![MLBB Redeem Codes Today Update for February 2024 [Active] 15 Seal of Anvil Crawlers Patterns Mobile Legends Latest 2023](https://b3300814.smushcdn.com/3300814/wp-content/uploads/2023/09/Mobile_Legends_Bang_Bang_cover.webp?lossy=2&strip=1&webp=1)